India’s consumer wellness market is massive and growing fast. However, its fitness segment remains highly fragmented, lacking consistent outcomes or a standardised user experience. According to The India Watch estimates published a year ago, the country was home to69,400 gyms (currently, this number can be well beyond 200K), but only 14% of these businesses belonged to branded or organised players. For users, it means wildly inconsistent experiences and limited brand loyalty. Therefore, most of them switch between apps, drop off after trials, or choose facilities based on convenience, cost or short-term fitness goals.

Amid this deep fragmentation and customer volatility, Curefit, which operates with its flagship brand cult, has built a strong retention model by treating fitness as a consumer service and a product-led ecosystem. Its multi-brand strategy across fitness services and D2C offerings is designed to cater to diverse price points, goals and preferences, with community and consistency at the core.

A case in point is cult Pass, a pan-India subscription model that gives users access to any fitness centre run by the brand, offering uniform service formats and quality standards. That consistency, scaled nationwide, has helped recast urban India’s perception of fitness — from a chore to a reliable wellness culture.

“cult changed intimidation into an invitation — it made fitness fun, accessible and consistent,” said Siva Kumar Pedhapati, the brand marketing head for Curefit’s fitness vertical, during a recent conversation with Inc42.

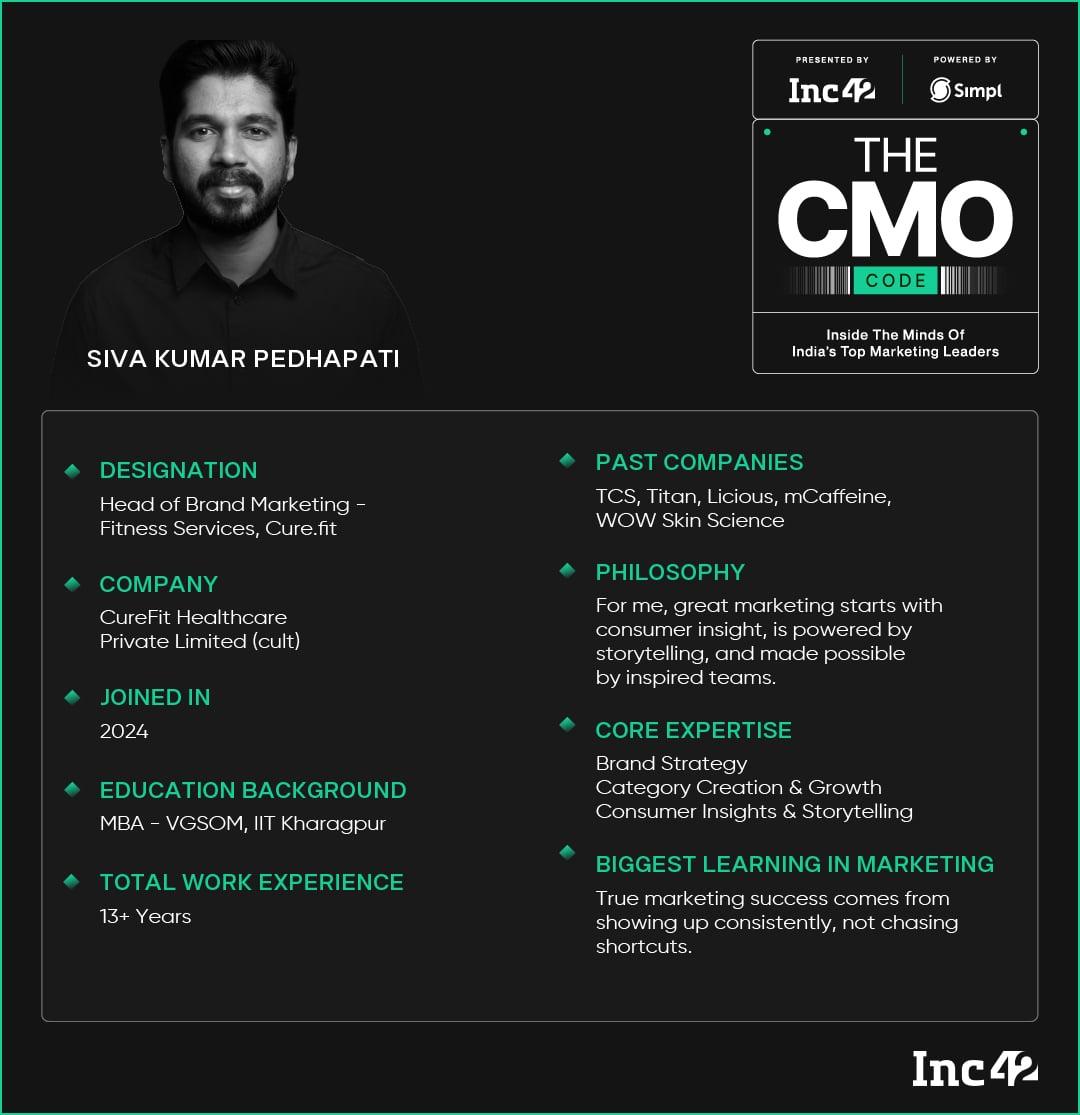

Pedhapati brings the combined DNA of legacy retail and digital-first direct-to-consumer (D2C) brands to the role. A B.Tech in civil engineering and an MBA from IIT Kharagpur, he started his career at Titan, working across watches, jewellery and eyewear for seven years, honing his consumer insights and the art of brand building.

Eager to step outside legacy systems, he transitioned to younger brands with sharper digital edges, including Licious, mCaffeine and WOW Skin Science. The constant throughput led to a focussed approach to brand building, as he explored the categories he cared about and applied foundational marketing principles across fast-moving sectors.

Pedhapati’s connection to the brand runs deep. He has been a cult.fit user since 2017, as its culture-first, community-driven approach resonated with him. So when the opportunity to lead marketing emerged in October 2024, it aligned perfectly with his personal ethos and professional ambition.

The role, he says, unites his passion for wellness with a deep desire to build purpose-driven consumer brands. He sees the next decade as pivotal for Curefit’s evolution and believes brand-led growth will be a key driver.

Brand loyalty, he says, is not a marketing goal. It is the outcome of excellent product design and delivery. Curefit leans heavily on data science, behavioural insights and well-targeted user communication to achieve that. All these hinge on a core concept called habit-building nudges — micro-interventions designed not to sell fitness services outright but to make fitness a consistent, effortless habit.

As Curefit doubles down on retention, engagement and standardisation, its internal playbook offers a glimpse into what it takes to build long-term stickiness in a low-loyalty category. Its service-cum-product-led, insight-driven approach provides many lessons for anyone building in India’s next-generation consumer stack.

But before unpacking Curefit’s internal playbook — how it maps user journeys, chooses metrics and runs campaigns — it’s worth pausing to understand how the brand has built its foundation and redefined how India works out.

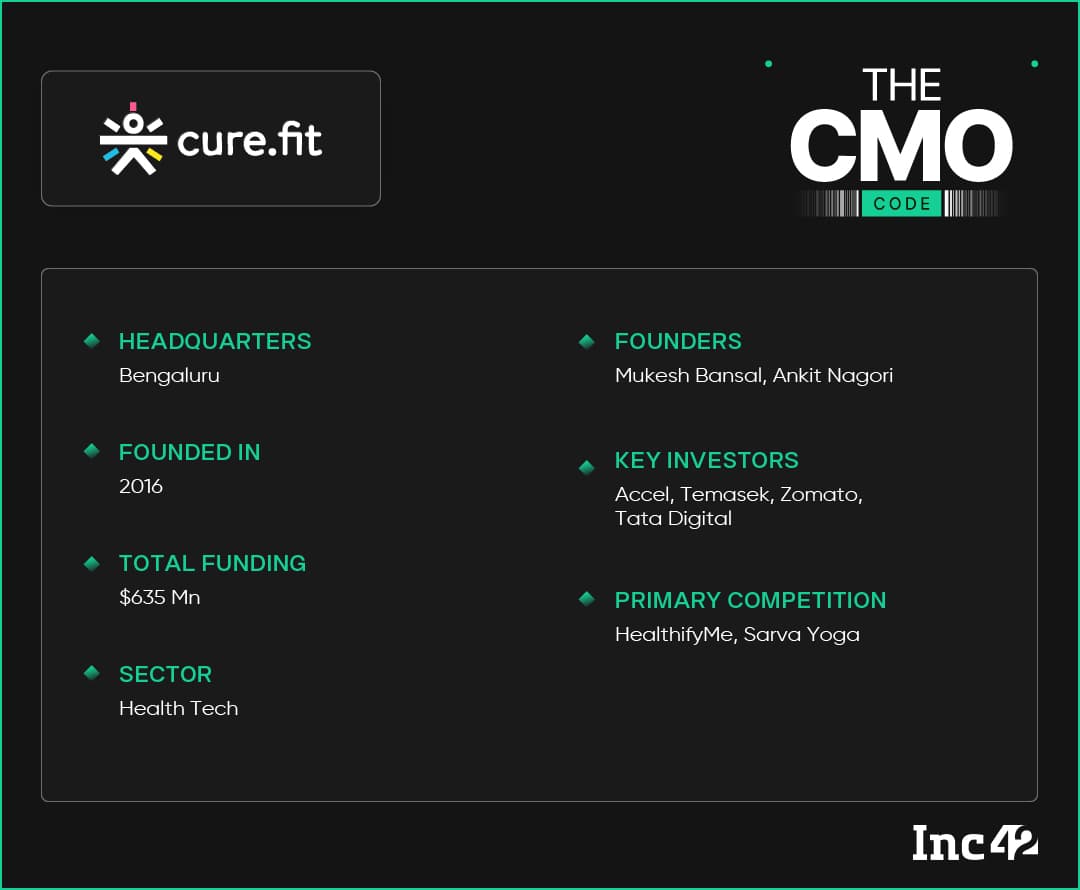

In 2015, Rishabh Telang (now a fitness expert at cult.fit) launched a machine-free fitness gym in Bengaluru called Cult. A year later, Myntra founder Mukesh Bansal and Flipkart executive Ankit Nagori, who were exploring a holistic preventive healthcare platform, heard about Cult’s unique model through word of mouth. In 2016, they acquired Cult and brought it under the Curefit brand—marking the birth of the Bengaluru-based health and fitness startup.

Curefit kicked off with a bold bet. It introduced an integrated, full-stack platform combining physical fitness (cult.fit), healthy eating (Eat.fit), mental well-being (Mind.fit) and primary healthcare (Care.fit). But by late 2020, the startup began streamlining operations to adapt to the shifting market conditions brought on by the Covid-19 pandemic. It hived off its health food vertical Eat,fit as an independent entity, and Nagori took charge as its CEO (he had reportedly swapped his equity in Curefit). After the split, Bansal continued to lead Curefit, focussing on fitness and positioning cult as its flagship offering.

That pivot redefined Curefit’s core strategy during the pandemic and post-Covid times.

The brand scaled cult.fit’s reach via a phygital model, acquiring players such as Gold’s Gym India and Fitternity while accelerating digital workouts. In 2021, it raised $145 Mn from investors such as Temasek, Accel and Zomato, hitting a $1.56 Bn valuation and joining the coveted unicorn club.

“When Covid hit and physical centres shut down, people doubted if virtual workouts would stick. But we delivered the right digital product and made it work,” said Pedhapati.

That digital pivot ensured business continuity during the pandemic and anchored cult.fit’s role as a digital-first fitness brand.

Curefit has focussed on building an active user community in the past two years. The aim is to evolve into a self-sustaining fitness collective, a community where users organise events, create content and take ownership, with cult.fit as the enabler.

“The only way to scale is to let our million-plus users do the heavy lifting with us,” said Pedhapati.

“Besides, it is emerging as a house of brands [more on this later]. We used to be just one brand. Now we are a brand collective. Gold’s Gym, Fitness First, Pilates Circle, cult neo and others are there, and some are more value-friendly offerings,” he added.

The next chapter? Streamlining the structure of the growing portfolio and positioning cult as the go-to platform for online and offline, premium and mass-market fitness services across India.

As Pedhapati shared, word of mouth has emerged as one of the most powerful levers for user acquisition cult.fit, the flagship fitness brand of Curefit.

“People who have tried cult.fit talk to their friends and families, and they all come in together. About 62% of our user acquisitions come from referrals, and our NPS is consistently above 50,” he said.

For context, NPS, or net promoter score, is a key metric that gauges customer loyalty and their likelihood to recommend a brand or its products/services. cult.fit’s score signals strong user satisfaction and advocacy.

The referral-driven user acquisition, which accounts for nearly two-thirds of the platform’s user base, has shaped the fitness brand’s marketing strategy. cult.fit has doubled down on referral programmes and invested in enhancing the overall member experience to amplify the network effect.

It also taps into corporate partnerships through cult Pass to promote fitness across workplaces, a move that brings in new users and positions wellness as a shared value. This B2B approach is another effective channel for user acquisition.

Although new users continue to flow in, retaining them presents a more formidable challenge. According to Pedhapati, the month of January brings a predictable sign-up spike driven by New Year’s resolutions. But the momentum fades within a few weeks.

cult.fit has moved away from the routine transactional model to counter this drop-off. Apart from selling memberships, it embeds fitness as a long-term habit and part of a healthy lifestyle. Also, a sense of community plays a significant role here, noted Pedhapati. Members are more likely to stay engaged when they have someone to work out with.

“As a result, the platform’s retention rate has reached 34%, with a steady upward trend,” he claimed.

Let us break down the brand’s eight core marketing strategies for driving user retention.

Building Habits & Triggering Stickinesscult.fit has engineered user experience to turn fitness into a lasting habit. At its core are intriguing features that encourage consistency and accountability. For instance, cult Squads enables users to find out who from their network is attending a class or inviting others to join, easing the discomfort of working out alone. Again, cult Ninja, a programme designed to motivate members through gamification and community-driven recognition, rewards regular activity. Members who exercise three times a week for a month get a public shoutout, reinforcing positive behaviour and stickiness.

“If someone works out three times a week for four consecutive weeks, they tend to stay consistent,” said Pedhapati.

The team also tracks last month’s activity rate, monitoring how many users remain active every month. This data helps forecast renewals and guides efforts to keep engagement high as memberships near expiry.

More Brick-And-Mortar Units For Greater Conveniencecult operates more than 700 centres across India, the country’s largest fitness chain in terms of physical presence. This is roughly six times the number of centres run by its closest competitor (the company did not disclose the name).

“This extensive presence means if you are in urban hubs like Bengaluru, there are at least two cult centres or more nearby,” Pedhapati says.

That proximity removes a major barrier — time constraint, to be precise. With a gym near one’s home or workplace, users don’t have to commute and will likely stick to their fitness training. Convenience, in this case, is not just a perk. It is a competitive edge that grows stronger as cult scales its network.

Variety In TrainingTraditional gyms tend to offer weights, cardio and a few other classes. But the narrow focus often leaves users boxed in, especially those looking for variety or just starting their fitness journey.

cult.fit, however, has flipped that script with a broad spectrum of fitness formats, from yoga and dance fitness to strength and HRX training, designed to suit every preference and comfort level.

This approach also attracts people who are wary of traditional gyms. Users can seamlessly switch between formats and locations, accessing unmatched flexibility tailored to individual goals, lifestyles, age and experience levels. This blend of variety and personalisation sets cult.fit apart in a market where few brands do it without compromising quality or consistency.

Raising The Bar On Training QualityOne of its core strengths is its trainers. Members often describe the guidance, coaching and personal transformation offered at cult.fit centres as unique and unmatched. It goes beyond mere fitness instructions, as trainers build trust-based, respectful connections with users, driving sustained engagement and ensuring real results.

User-Led Brand BuildingFor cult.fit, community isn’t just a nice-to-have. It is a growth driver and a structural advantage most competitors cannot replicate. The brand’s community-building strategy rests on empowering its members rather than relying on external influencers.

“Our community members are our influencers and endorsers,” said Pedhapati.

At the heart of this initiative is the cult Champions programme, a handpicked group of highly engaged users who help onboard newcomers, serve as peer mentors, resolve on-ground issues and organise local events like dance sessions or weekend treks. These ‘champions’ drive grassroots engagement from within, creating a sense of belonging across centres. Cult provides tools and support but allows its ‘champions’ to take full ownership, keeping the community-building model scalable and authentic.

To amplify user influence beyond physical centres, cult offers them its digital platforms to host and promote events. In addition, it is creating limited-edition gear around member-led activities. For instance, a pair of shoes celebrated a member-led trek and a T-shirt honoured the founder of the 9 a.m. Club, set up to build fitness routines. All these blur the line between branding and community.

The cult Champions programme now includes more than 4K members across three cities, each acting as a trusted voice within their communities. It is a model built not on celebrity endorsement but user-driven relevance. The impact? Higher member stickiness, lower churn and a playbook for turning power users into growth levers.

Use Of First-Party DataWith lakhs of users engaging daily at its centres, cult builds real-time behavioural cohorts based on class preferences, attendance patterns and individual fitness goals. These cohorts power more targeted and timely outreach rooted in actual user behaviour.

As the fitness industry braces for a cookieless, privacy-first future, cult early bet on rich first-party data proves prescient. The brand is not just compliant; it holds a competitive edge.

As for performance assessment, the marketing team has moved past vanity metrics like clicks and impressions. The focus now is on business-critical KPIs such as trials attended, walk-ins and the holy grail — habit formation. Retention is no longer a post-sale checkpoint but an ongoing journey based on a continuous feedback loop. Intelligent nudges, streak tracking, and milestone rewards are all part of keeping users engaged.

AI For Personalisation, Precision And Scale“We have always believed consistency is a better success metric than just conversions,” said Pedhapati.

Artificial intelligence threads through nearly every layer of cult.fit’s operations. It powers expansion planning by analysing footfall and local demographics, fine-tuning media mix for better ROI and maintaining operational consistency across centres.

Its best consumer-facing innovation is the AI Trainer embedded in the cult app. Drawing on nine years of in-house fitness data, it offers personalised workout plans, factoring in fitness level, rest requirement, equipment access and nutrition goals. In a market like India, where access to personal trainers is limited, this AI tool is more than a convenience — it is a leveller. cult.fit is pushing well beyond its physical footprint by delivering personalised, structured fitness at scale.

High-Impact Marketingcult values passion for fitness and a deep understanding of its community, often bringing in content creators and storytellers instead of conventional marketers. New hires are vetted for how seamlessly they can plug into the brand’s DNA, especially across digital channels.

Although the team is growing organically, it focusses on high-impact initiatives and their perfect execution, rather than spreading thin across multiple projects.

“Our strategy is not about doing a hundred things. It is about doing five things well and making them count,” said Pedhapati, underlining the team’s quality-first approach.

Next On The Cards: Building A House Of Brands

Next On The Cards: Building A House Of Brands As Pedhapati has mentioned, the fitness brand is moving towards a classic house-of-brands model — an ambitious play in a market where few have successfully executed it for long-term growth.

This approach is still a complex and nuanced undertaking that goes way beyond launching multiple sub-brands with distinctive features. Instead, each one needs the room to grow on its own, but also benefits from the scale and credibility of the parent company. That is a tricky balancing act, and not many get it right.

Pedhapati knows this playbook well, this nitty-gritty of building category-defining brands within a unified corporate structure. At Titan, he saw firsthand how the parent company built or scaled distinct consumer brands even within the same category — Tanishq, Mia and CaratLane in jewellery and Titan, Fastrack and Sonata in watches. Each maintains a clear identity with minimal overlap, yet operates cohesively within the broader enterprise.

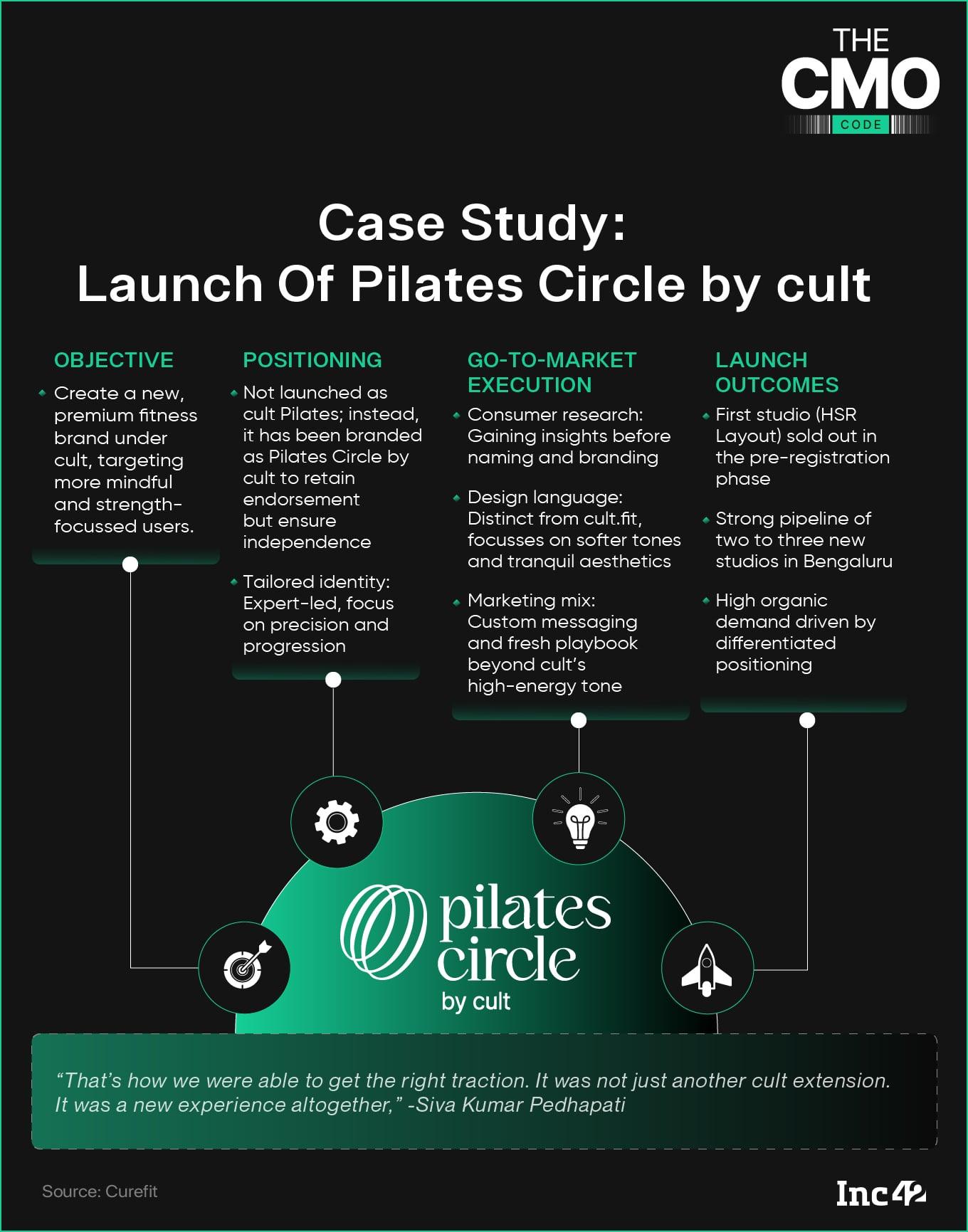

However, the dynamics at cult may play out differently. One key challenge is communication. A brand strategy can look sharp on paper but often fails to resonate with users in practice. The result? Cannibalisation occurs when the master brand overshadows all other entities. When brand messages blur, they confuse consumers. And when a product fails to align with its target audience, even a strong message loses its impact.

Although the brand has a strong marketing playbook, especially for growth, Pedhapati admits it is not a plug-and-play solution and requires frequent tweaking. “We are constantly revisiting the playbook,” he said. “It doesn’t always work when we are launching something new.”

It means every new brand must be built from scratch — from understanding the user to finding product-market fit, crafting the right media mix, and getting the messaging and channels right.

Interestingly, the launch of Pilates Circle is a gravitation towards this house-of-brands approach. It is a high-end offering and a clear break from the brand’s core identity. While cult.fit is energetic and community-driven, Pilates Circle is more refined, focussing on balance, strength and the mind-body connection. The differentiated positioning is deliberate. It is an endorsed brand that stands apart, not just another fitness class.

“Right now, we are in an interesting stage. We are still startup-minded but almost a decade old. Many of our frameworks have been developed internally and have stood the test of time,” said Pedhapati.

What It Takes To Win The Long Game In Fitness

What It Takes To Win The Long Game In Fitness ndia’s fitness industry has grown rapidly since its pandemic-era pivot from offline to online. In 2025, the country’s gym and training market is projected to generate $598.9 Mn in revenue, growing at an estimated CAGR of 4.9% during 2025-2030, according to Statista.

Despite this momentum, market penetration remains low— just 0.6%, compared to 22% in the US. The bigger challenge, however, lies in customer retention. The domestic fitness landscape is highly fragmented, with user loyalty proving hard to pin down. In a market saturated with budget gyms and free online workouts, most users drop off within three to six months.

Curefit is tackling this issue head-on, not by chasing scale at any cost but by deepening user engagement through a stickier product experience. Its strategy leans on gamified challenges, loyalty programmes and a seamless hybrid model that allows people to switch between therapy, home workouts, studio sessions and personal training. The emphasis is on consistency, not just conversion.

“There is a massive white space here,” said Pedhapati. With new formats like Pilates Circle by cult and high-energy experiences such as cult UNBOUND [a high-energy, inclusive functional fitness championship], the brand is expanding its service bouquet to keep users coming back. But beyond retention, the deeper goal is to enable a behavioural shift, cultivating intent and helping more Indians start and sustain their fitness journeys.

From the CMO’s lens, marketing in this space is also evolving. A key lesson is: Conventional strategies don’t always work well. Shifting across categories or organisations often demands the unlearning of familiar playbooks. What works in one context may fall flat in another. On the other hand, understanding consumer nuances and product context sets the foundation for meaningful outcomes.

Focus is another challenge. In a sector full of creative possibilities, the ability to cut through noise and align teams around a few high-impact initiatives can truly move the needle. According to Pedhapati, transitioning from agency-led to in-house execution compels marketing heads to operate with greater agility without losing sight of long-term brand value. Today’s marketing heads must be adept at cross-functional collaborations, understand business levers and stay attuned to fast-moving industry dynamics.

“The biggest shift is that CMOs can no longer afford to be arm’s-length strategists,” he said. “They need to be in the trenches, building teams, pressure-testing narratives and iterating in real time.”

The post The Method Behind Curefit’s High Customer Retention In A Low-Loyalty Market appeared first on Inc42 Media.

You may also like

Wednesday season 2 star's family didn't recognise her after extreme transformation

ECI should conduct proper probe: BJP leader on Pawan Khera's two voter IDs

Should girls not wash their hair during their periods? Know the truth behind this.

'My mother had nothing to do with politics': PM Modi's first reaction to 'abuse' row; slams RJD-Congress

GMB's Susanna Reid forced to intervene after co-star's brutal swipe at Rylan Clark